Episode

How Can the United States Improve Its Infrastructure? (41:19)

Many say infrastructure in the United States is not what it should be, which has some politicians calling for a massive infrastructure initiative. Advocates say it will have positive effects on our economy. However it comes with a large price tag, which some people say not so fast. In this episode, Chris Edwards, director of tax policy studies at the Cato Institute; Tracy Gordon, acting director of the Urban Institute-Brookings Institution Tax Policy Center; and Clifford Winston, senior fellow in economic studies at the Brookings Institution discuss: how can the United States improve its infrastructure?

Transcript

Pete Buttigieg – Transportation Secretary: You don’t need an engineering report to know that driving on American roads, they’re not the way they should be.

Sallie James: Many say infrastructure in the United States is not what it should be.

Unidentified Speaker 2: In their most recent infrastructure report card, this group gave the United States a D+.

Sallie James: Which has some politicians calling for a massive infrastructure initiative.

Joe Biden: It’s a once in a generation investment, unlike anything we’ve seen or done since we built the interstate highway system and the space race decades ago.

Sallie James: Advocates say it will have positive effects on our economy.

Senator Chuck Schumer: Getting money for infrastructure helps us revitalize our economy and create new jobs.

Sallie James: But it comes with a large price tag.

Nancy Cordes, CBS News: We are talking about a 2 to $3 trillion dollar spending bill on everything from roads to bridges to broadband, rail, ports, even the electrical grid. And the White House wants to pay for all of it with tax increases.

Sallie James: And that has some people saying not so fast.

Larry Kudlow: Look, everybody loves infrastructure: bridges, roads, highways, tunnels, repair. That’s fine. That’s not necessary, $3-4 trillion dollars. You could do that for $1 trillion dollars. You can do it through user fees, through public-private partnerships, through toll roads, things of that sort.

Senator John Barrasso: Real infrastructure are roads and bridges, and yet that’s less than 6% of the money on this massive spending bill. So, when you take a look at all of this spending, you say, is this what the American people want in infrastructure? And I say it is not.

Sallie James: If Americans can broadly agree on nothing else, we should be able to agree that much of the bitterness and political tribalism that drives our public discussions is unhealthy for our country. In order to debate contentious public policy issues in a respectful and engaging manner, without abandoning deeply held principles, the Cato Institute, in collaboration with the Brookings Institution, present Sphere.

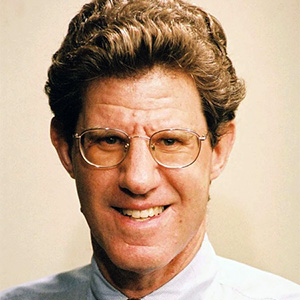

Sallie James: In this episode: How can the United States improve its infrastructure? Welcome to Sphere. I’m Sallie James. Infrastructure has become something of a buzz word whose definition is fuzzy at best. It definitely means roads and bridges, but it can also include your internet connection, water, electricity, airports, and trains. Regardless of how many things it includes, how to improve it is a trillion-dollar question. Joining me today for this discussion are Chris Edwards, director of tax policy studies at the Cato Institute, Tracy Gordon, acting director of the Urban-Brookings Tax Policy Center, and Clifford Winston, Senior Fellow in Economic Studies at the Brookings Institution. It’s my pleasure to welcome you all to Sphere. Now, the three of you are economists. I am also an economist. So, in addition to keeping this conversation civil, I’d like to encourage us all to discuss this in a way that non-economists can understand. Perhaps we should start with the question of what is infrastructure? Tracy, perhaps we’ll start with you.

Tracy Gordon: Sure. I think that you highlighted a fundamental vagueness that often comes up in these conversations. People will say things like the systems that allow us to conduct business activity to move people, ideas, products, a network of roads, bridges, as you alluded to, but also power grids, also water, also broadband access, but I think we’ll probably talk a lot about the American jobs plan that has been proposed. That is a definition of infrastructure that also includes what we typically think of as investment. And so, I think you can see a lot of different takes on what would fall under this rubric.

Sallie James: Clifford, does that fit with your definition of infrastructure?

Clifford Winston: I think the thing to point out about infrastructure is it’s, at least historically, perceived to be a public good. And the key part about that is that it involves government provision of it. And this is really the heart of the policy debate in that the government is involved, and otherwise, why is it the case that markets provide infrastructure? The answer is, as I said, traditionally it’s thought to be a public good, meaning that people are not excludable from using it, yet they can avoid paying for it. And that historically has motivated government control. And I think as we shall see, infrastructure is far from being a public good, and having government control has generally been a disaster.

Sallie James: Chris, what are your thoughts?

Chris Edwards: Well, you know, one really broad definition of infrastructure is really long-lived fixed assets or a capital investment. The accounts produced by the Department of Commerce that produce our GDP statistics also produce a set of data that measures all the fixed assets, all the hard assets in the United States. And if you look at those accounts, you can see in the private sector, you’ve got a vast range of hard assets, like pipelines and broadband infrastructure, in factories and satellites, all kinds of stuff like that. And then at the state and local level, you’ve got highways and schools. Then at the federal level, you’ve got things like the air traffic control system, the U.S. postal system, and assets like that. Those accounts produced by the Department of Commerce show that about 65% of our infrastructure is in the private sector, about 30% is in state and local governments, and then just 5% is in the federal government. And, so, the interesting thing is, is even though the federal government owns just around 5% of all of our infrastructure, it actually controls a lot of the other infrastructure in the nation through taxation, and through regulation, and that sort of thing, as well as through federal aid for state and local infrastructure. So, the federal government owns a little, but it has a lot of control over the rest of the infrastructure in the United States.

Sallie James: Well, that brings us to the topic of the plans that the administration has for infrastructure. The American Jobs Plan from the Biden Administration says, and I’m quoting here: “The United States of America is the wealthiest country in the world, yet we rank 13th when it comes to the overall quality of our infrastructure. After decades of disinvestment, our roads, bridges, and water systems are crumbling. Our electric grid is vulnerable to catastrophic outages. Too many lack access to affordable, high-speed internet and to quality housing. It has never been more important for us to invest in strengthening our infrastructure and competitiveness, and in creating the good-paying, union jobs of the future.” So, there’s two things going on here: People saying we need to fix stuff, arguing the substantive merits of the need for improved infrastructure, and then there’s the people, or the aspect, who say we should use this as a way to create union jobs. Economists are generally skeptical of plans like this being able to immediately mobilize jobs. Tracy, you’ve described the funding mechanisms for these infrastructure programs as complex webs. Tell us about how those complex webs might affect the impact of any infrastructure plan.

Tracy Gordon: Right. I’m fond of saying there’s no such thing as a national infrastructure, but really regional and local projects. So, as Chris points out, the ownership of infrastructure varies a lot by type, but if you look at just spending overall for all those types of infrastructure, service, transportation, water, energy, about 80% of it happens at the state and local level. And beyond spending, state and local governments make decisions about regulation, about procurement, about which projects to do that affect the bang for the buck that you get. So, one thing that you notice in this very large academic literature about the economic returns to infrastructure is there’s often a qualifying statement like well-chosen projects can generate a bang for the buck of 10%, but that issue of how do you choose those projects is often left out of the discussion.

Sallie James: So, Clifford, you recently wrote a piece for Barons called “How Federal Infrastructure Dollars Get Nickeled and Dimed,” describing the sad journey of a federal dollar before it gets anywhere it can make an impact. Do we need to change the funding mechanism in order to increase effectiveness?

Clifford Winston: Yes. In a word, yes. You significantly change the funding mechanism. But in the process then we can realize what it is that pricing does. So, the funding mechanism that we want is pricing. Now, pricing does three things: One, it affects behavior of users, and in the process, that can significantly reduce the costs that users are putting on the infrastructure and the costs they incur. It can reduce them, all right? So right there, there’s savings and less stress on public finance for that. Secondly, they can raise money. So, you set charges for people who use the thing based on the costs, again, that they are incurring for using it that generates revenues. And under, you know, certain what we call technical conditions, basically the infrastructure can be self-financing. And then, probably the most important thing is that it signals efficient investment. That is, it is absolutely ridiculous to think about spending without pricing because you have absolutely no guidance to use. And what happens in infrastructure is since the prices generally are below cost, there’s always excess demand, and you’ll continue to have pressure; build more, spend more, so on and so forth. But obviously, if you set the prices right, then you realize, oh we don’t need to do that, and then we can assess alternative investments, as we should, based on cost-benefit analysis. So, the very first thing that needs to be done is get the efficient prices, and then many things – a staggering number of things – will follow to make the system much more efficient.

Sallie James: Chris, is the funding mechanism the obstacle here? Or do you see more fundamental problems with federal infrastructure plans of this type?

Chris Edwards: Yeah, I agree entirely with what Cliff says, and I’d even step back one step further. In the quote you read from the Biden plan, it correctly pointed out that some U.S. infrastructure is in poor shape and we need more investment. And I remember President Trump complained, for example, about the New York area airports, like LaGuardia, were in poor shape and we needed to upgrade. And, indeed, in President Biden’s plan, I believe he complains about the shape of U.S. airports and say we don’t have the best airports in the world. And that is true. But I think, so, the fundamental thing I think we have to look at is the governance of this infrastructure. A lot of it is not so much how much we spend on it. It is do these assets, does this infrastructure have good management? And with airports, for example, I know Cliff is an expert on this, many, many countries around the world have privatized their airports. About half of the major European airports are in the private sector. If you fly into Heathrow in London, for example, that’s a publicly traded corporation that runs that airport. Private airports tend to raise, they raise the money for investment and operations through user fees, which as Cliff pointed out, is an efficient way to fund infrastructure. So, a nice thing about privatization, where it’s possible, is you get often better governance as well as you get user fee financing and so you get more efficient decisions on management, and capital investment, and that sort of thing.

Sallie James: I want to turn to the politics of this now and about the fact that Americans don’t seem to care too much about infrastructure. One headline on CNN reads, “Americans don’t see infrastructure as a priority.” In a recent Pew poll, just 32% said improving the country’s roads, bridges, and public transportation systems should be a priority. That ranked second to last among 19 items asked about. For comparison, strengthening the economy and dealing with the pandemic were 1st and 2nd, respectively. A January Monmouth University poll came to a similar finding. It tested 15 areas for the federal government to address, and a mere 17% said transportation and energy infrastructure was extremely important. That was dead last in the poll. Again, the pandemic and the economy were at or near the top of this list. Chris, what do these numbers tell us about the political will to actually pass this bill?

Chris Edwards: Well, people often say that infrastructure bills in Washington are bipartisan and there is a lot of truth in that – although I say it’s often the funding mechanism or you get differences between the parties. Both parties want to spend more on federal infrastructure in their congressional districts, but neither party likes to raise the federal gas tax to fund highways, for example. So, the funding mechanism, there are differences between the parties. President Biden, I think, has introduced a number of items with his infrastructure plan that are also going to cause some partisan differences. He would tie union provisions to a lot of his infrastructure funding. That’s not popular with Republicans. With regard to the general public, you know, they seem to be more willing to accept tax increases to fund infrastructure at the state level. So, while the federal government hasn’t raised its gas tax in a few decades now, about half of the states have raised their gas taxes in just the last five years. And actually, state gas taxes and vehicle fees are actually much higher than federal gas taxes these days. So, most of the funding for highways now comes from state governments. I think that’s a good thing. I think that, you know, states can decide themselves how much investment they need, for example, in their highways and their mass transit system. So, I see more willing, willingness, by the public to accept infrastructure charges and tax increases at the state and local level than I do at the federal level.

Sallie James: Tracy. Do you have any thoughts?

Tracy Gordon: It’s certainly true that gas taxes have been more successful at the state level than the federal level. So, virtually all states have raised their gas taxes since 1993, which was the last time the federal government raised its gas tax. But if you look especially at the gas tax increases in the last 10 years or so, not that many have been more than, say, five cents a gallon more. So, they’re incremental kind of small changes. And I think that one of the problems in terms of public support of infrastructure is that people often don’t see a connection between money that they send to Washington and improvements in infrastructure that’s close to home. So, how is my spending more on federal gas taxes going to fix the pothole that’s on my street or make my commute better? And part of that is the complexity of these funding formulas. It’s, you know, funding is tied to things like, well, it’s not tied to the performance of roads, it’s not tied to their quality. So, rural states see more spending than they should, whereas like the highly and intensely used interstate highway system spending is not what it should be. And so, until we get these funding formulas fixed, I think that public confidence, in especially Washington’s ability to spend infrastructure dollars, is going to be limited.

Sallie James: Clifford, what do you think about that?

Clifford Winston: So, the gas tax actually may do more harm than good in ways that people don’t appreciate. Remember, the gas tax is used not only to charge cars, but to charge trucks. Now, the damage that the trucks do to the road depends on their axle weight, and trucks that have fewer axles get better fuel economy. But those are the ones that are tearing up the roads. The worst trucks are like cement trucks, garbage trucks, these overloaded things, and gas prices, gas taxes give them incentives to use fewer axles, which does way more damage than those that have more axles. So, by sticking with the gas tax, we’re actually creating more damage to the road and increasing the maintenance bill than if we didn’t have those taxes. So, those are the kinds of things that amazingly politicians overlook. But it’s part of the bigger problem, which Chris alluded to, in governance, is that there is absolutely zero feel for innovation. The reason why people have no sense about infrastructure and its importance is it seems dull. Nothing ever changes. In a sense, it was the same way, the same thing about regulated industries. You know, airlines seemed fine when they were regulated. The good old days, right, when you can have a seat by yourself, 50% load factors, who cared? Right? Who ever knew or ever thought that was insane? Right? The old days of railroads. Well, they’re kind of slow, inefficient, and so they don’t know where your freight is. That’s just the way it is. No one could imagine what innovation would take place in those industries once they were deregulated. It’s exactly the same thing with infrastructure. There are countless things that could be done – and would be done – if they were out of the public sector. People just have no idea. And so, it seems, like, oh it’s kind of a boring thing. We’re not worried about it. But if they knew how much they were missing, they would worry a lot about it.

Sallie James: So, I wonder if perhaps politicians are onto something when they, when you talk, Cliff, about how kind of boring infrastructure – selling this as an infrastructure program per se, because the infrastructure package is generally being sold as a jobs program. Clifford, you’ve got some strong thoughts about that. Should we be measuring the success of an infrastructure plan in terms of jobs created?

Clifford Winston: So, you know, we’re all economists here. And, you know, there’s something that we all agree on. You use the right policy tool to address the right problem. Right? So, you step back and say, okay, what are we trying to do? Right? And if we’re trying to improve infrastructure, then economists are going to say, okay, we know the appropriate policy tools: efficient pricing and investment. Okay? If we’re trying to increase employment, economists are not going to say let’s spend money on infrastructure. But it’s hard for me to intuitively see if you really want to increase employment that you want to be subsidizing capital, which is effectively what this program is offering to do – and bear in mind there’s an opportunity cost. You go ahead and you do this inefficiently, right? That is money you could have spent to increase employment in a better way. And I think that’s our fundamental problem, is no one is just stepping back and asking what is the optimal way to raise employment, first, before jumping in on infrastructure. And that’s obviously not going to lead to an efficient solution and will lead to considerable waste.

Tracy Gordon: Can I just say one thing on the job creation argument? I think that held a lot more sway in the last recession, we had a lot of unemployed construction workers, and so it was obvious that skills from building houses were maybe transferable to building roads. And so, we actually did see a pretty good bang for the buck on infrastructure spending because of those economic conditions, as well as the conditions that were tied to federal aid, especially the need to get the money under contract within 180 days. So, you know, in this kind of a recession where we are dealing with service sector jobs that have been lost, that argument about sort of immediate stimulus does not have the same kind of sway. However, I think there’s still the argument, and I think, you know, Cliff and Chris would agree, that the real gain from infrastructure is the long-term gains in economic growth, the long-term gains in productivity. So, there may be jobs that are created because of those industries that benefit from having fewer bottlenecks, reduced travel times, or not to mention sort of the non-pecuniary benefits of people that are able to, you know, enjoy recreational activities, see their friends and family more once we’re able to travel. So, you know, I don’t think that immediate job creation is the right way to think about infrastructure spending except under limited circumstances.

Sallie James: So, speaking of waste, all three of you seem to agree that infrastructure programs can be good if they’re focused on these high-value innovative solutions. But there’s always a pork barrel problem. How can we make sure that doesn’t happen? Tracy, your thoughts about funding mechanisms or other incentives to prevent kind of corruption earmarks, that sort of thing?

Tracy Gordon: You know, there has been this move away from federal funding for specific projects or earmarks, but I don’t think that we have reexamined the fundamental funding formulas as much as we could. It would seem to me that when you’re talking about spending $2.3 trillion that is the time that you can get some of these long-term kinds of process reforms. And so, I think there’s a bit of a missed opportunity here. There are some innovations in this plan, and so I think there’s more emphasis on fixing existing assets instead of building new ones, and that’s been sort of a victory for the economics profession getting that seen. And there’s even language in there, Cliff, about fixing it, not just first, but fixing it right, which I think speaks to some of the arguments that you’ve made in the past about, you know, making investments more durable so they don’t require more operations and maintenance spending over time. So, I think there’s been a little bit of reform, but I agree very much with the tenor of the conversation so far about how just over time, if you look at these programs, they don’t change very much. And there’s been much more emphasis on showing increases in output, increases in lane miles rather than innovations and how we finance these investments.

Chris Edwards: Yeah. To build on what Cliff and Tracy were talking about with regard to innovation, this is a really important issue. And you know, some of the good news here is that, you know, we live in a global economy and there are many other high-income advanced nations that have been very innovative on their infrastructure. And U.S. policymakers ought to spend more time looking around the world looking for best practices around the world. So, you know, some things that come to mind here, our air traffic control system faces a lot of challenges. It’s lagging with new technologies. It’s often, it’s long had a problem with developing new technologies. But the Canadians 25 years ago, they privatized their air traffic control system. They moved it into a stand-alone nonprofit corporation which is self-funded, and this entity has been very innovative and it’s something that U.S. policymakers have looked at. Air traffic control is moving from old fashioned sort of radar to 21st-century satellite navigation. The Canadians and their privatized system are leading on that. So, that’s the type of lesson I think U.S. policymakers, we need to look abroad and see what other countries are doing. Another example of this with highways – a lot of other countries have moved more toward public-private partnership for building highway expansions and refurbishing highways. This gets private sector management as well as finance involved in highways. Private companies sort of take over the design build as well as the long-term operation and maintenance. And a lot of countries have found that that system works better to keep costs under control and to create better long-term management. We’ve done a little bit of this public-private partnership in the United States for highways, but I think we should probably do a lot more.

Sallie James: Tracy, do you agree with that?

Tracy Gordon: I do think Chris is right, that we’ve seen very limited use of public-private partnerships for highways. I think it’s something like less than 3% over the last couple of decades for which we have data. And I agree completely with the need to align incentives. Well, there are going to be some investments that you just can’t charge people for. So, one example that I heard recently was another bridge to the Cape in Massachusetts. There are two bridges now, I gather, but they are often, you know, backed up. And so, there is a market, there are people who are willing to pay, you know, maybe $20 for, you know, a trip that is congestion-free to go there. Not every investment is like that, not every investment has the ability to charge. And then that means that the private investor, you know, won’t get repaid. And so, there’s this fundamental need to distinguish between financing and funding. And there still needs to be a funding source. One difference between the United States and these other countries that have used P3s is that we have this $4 trillion municipal bond market where capital is actually very cheap. And so, in order to get those private investors, you have to guarantee them a rate of return. The rate of return depends on the ability of the government to levy charges that people will pay to use the asset and that’s a political problem as well as sometimes an economic one when you have the alternative of borrowing, especially right now very cheaply, in the muni bond market, that might not look so enticing. And then there’s the whole contracting issue of how do you write a contract so that the public taxpayers are not left holding the bag?

Sallie James: Cliff. Would you like to talk about the difference or what’s better in terms of user fees versus sort of tax-preferred ways of funding infrastructure investments?

Clifford Winston: You know, it’s often not appreciated that the mode, at least in transportation, lead the infrastructure. We had cars before we had roads. We had planes before we had airports. We had planes before we had air traffic control. What that tells you is that the modes that are coming up, autonomous vehicles, drones, pilotless planes, supersonic planes, many things, are ultimately what’s going to be driving infrastructure. I imagine we could have this conversation 20 years from now and the infrastructure hasn’t done anything in change. But what’s going to happen is the modes are going to be putting pressure on the infrastructure to sort of change and align themselves with what they’re doing. And until they do, my guess is it’s, you know, continuing to have status quo bias. You need pricing because of the many things that it does, and the efficiencies are going to follow from there. Now, you know, earmarks, as you asked earlier, I think that’s just a cost of the politics in that if you want to get rid of earmarks then you’re going to have to get this stuff out of the public sector and simply allow private airport competition, private ATCs, start experimenting with private roads. I’m not saying these things are easy to do. Airports, I would think, would be easier than roads. But otherwise, with all that money around, it’s just too easy to sort of find ways to try to get at it for your own political purposes.

Sallie James: Chris, any thoughts on that?

Chris Edwards: You know, one of the issues, I think, with government ownership and management of infrastructure is they often underprice their infrastructure, which induces overconsumption. I mean, a good example here is the federal government owns a lot of the federal, a lot of the water infrastructure out West that provides irrigation water to farmers, we tend to underprice that water, which induces overconsumption. And there’s lots of, there are lots of examples of this. And so, one of my concerns about the Biden plan is it would provide federal subsidies for infrastructure. So, it provides I think it’s $69 billion for urban water systems. I think $25 billion for airports. That financing or funding takes away from user charge funding of that infrastructure. So, with urban water supply, for example, as many systems may need upgrades, I think the best way to upgrade is to use user charges to increase the capital investment. And that tends to reduce consumer demand, which is generally a green way to do the financing. So, I think user charges are good in a lot of ways. Economists like them because, you know, user charges – because they’re economically efficient – the are also generally a green way to finance infrastructure.

Clifford Winston: You know, what is so bizarre though – I have to say this – is that, you know, people think of these as user charges. Fine, they are prices. I mean, consumers every day, in every transaction, every good, every service, they confront prices. And there’s nothing odd about that. Yet somehow there’s a new name for prices when it comes to infrastructure, user charges. And, you know, that irritates people. It’s just pricing. You know, we’re just trying to replicate an efficient market setting. You know, at this point, there’s the belief – and I think most of the time it’s going to be shown to be erroneous – that government needs to be involved because of the public good aspect of infrastructure. But we can explicitly identify people who are imposing costs, and we can charge them so they’re not going to be free riders. And given that, it’s just like everything else that people experience, and you need to be charged the cost of your good or service. People accept that and everything else. I don’t know why with infrastructure there’s any debate about it.

Tracy Gordon: I think you have people who are currently using the assets without paying. Right? So just pointing to all the other places where they do pay doesn’t really change their feelings toward having to pay where they previously didn’t have to, right? And I agree about the efficiency argument. You know, what the Biden administration has proposed is really a very significant one-time investment of $2.3 trillion dollars, which is undergirded by this big corporate income tax reform. But then after that big chunk of money, these are not, these are not ongoing programs. If you had user fees, in some ways that would make some of these spending programs more sustainable because they would have their own revenue source and the revenue source would be tied to demand management or making sure that you’re not building assets that are too big for what people need.

Sallie James: Tracy, what about equity though? It’s one thing to put a user fee on another bridge to the Cape in Massachusetts, to Cape Cod, but you know, a lot of these – to the extent that infrastructure is a public good, in other words, you know, non-excludable, and that poorer people want and need access to roads as well – how do we address the equity problem if we started to introduce a more rigorous system of user fees or prices, as Cliff would say?

Tracy Gordon: Well, I think what Cliff and Chris would probably say is you give people money right? That you charge for using infrastructure at high-use times at peak hours, and then you basically sort of hold them harmless by providing some kind of a cash transfer. You know, in practice that’s complicated to do. There are people who, for whatever reason, have to travel at peak hours. How do you make sure the subsidy is appropriate to their conditions and their needs? And then, I think just most importantly politically is that it is very difficult to charge fees for a lot of things that people are used to getting for free or for new assets that are going to be built, unless you have something that looks more like a concession kind of model where people are sort of, it’s almost like a quasi-private kind of asset that you’re building. So, we just have a lot of work to do in terms of changing people’s expectations about what they get from government and what they pay for.

Sallie James: It seems that the differences between the three of you are largely ones of emphasis and degree. Government involvement, how much thought has gone into this bill as opposed to having a bill at all. So, as we wrap up this program and turn to final thoughts, Chris, apart from some of the privatization and best practice adoption that you spoke about earlier, what, if anything, should the federal government do, in your view?

Chris Edwards: So, one way to think about the Biden plan is he provides two big sets of new subsidies: More subsidies to state and local infrastructure, highways and that sort of stuff, and more subsidies to private sector infrastructures such as electric vehicles, and broadband, and those sorts of things. I think rather than increasing federal subsidies the federal government can do some reforms to allow state and local governments to raise money for their own infrastructure. And two really good examples of this: There’s currently generally a federal government ban on the state’s putting electronic tolling in on their interstate highways. The interstate highways are owned by state governments and in my view that federal ban on tolling ought to be completely repealed. We ought to leave it up to state governments. If they want to put electronic tolls in on congested parts of their highways, I think that’s great and a step forward, a step towards Cliff’s pricing. Another example of that is the big airports in the United States are substantially funded by their own charges. There’s a passenger facility charge that airports put on the price of tickets for airport users. The federal government puts a cap on that. They don’t allow airports in the United States – they put a cap on airports raising their own money for expanding their own infrastructure. So, I think the federal government ought to repeal those sorts of regulatory restrictions and allow state and local governments to raise money for their own infrastructure. And then secondly, you know, the Biden plan does a lot of subsidies for private sector infrastructure, which I think is a really dangerous direction for the federal government to go. As one example, it provides about $170 billion for electric vehicles and the charging infrastructure that it appears we’ll probably need with electric vehicles. In just doing a little bit of research on that myself, it is actually remarkable how much money is already being spent on electric vehicles by the car companies, and electric vehicle charging stations by all kinds of private corporations. There are already 30,000 charging stations in the United States for electric vehicles. You see them springing up all over the place, in Target parking lots and Walmart parking lots. There’s already a whole bunch of companies that are branching across the nation, putting in charging stations, not just for Teslas, but for the other electric vehicles. This is great. This is, you know, private sector innovation, and, you know, so electric vehicles do seem to be the future. Let’s let it happen. Let’s get the federal government out of the way. We don’t need more subsidies, I think. We’re already seeing private sector innovation. And that’s great. Let’s let it happen.

Sallie James: Clifford, final thoughts. What’s your big recommendation?

Clifford Winston: I think the general problem with government intervention – and this is speaking as someone now who’s older, as opposed to when I started many years ago – is you do not realize how much innovation government suppresses. And it’s not just infrastructure, it’s in virtually everything. And you see slowly when the clamps are left off how things could be so much different, so much better, than they are now. Unfortunately, government has been entrenched with infrastructure for a long, long time. The inefficiencies that are accumulated are huge and it’s very tough to get any sort of reform. What one needs to do is get a glimpse of what things could look like. We don’t have time for me to tell you what roads could actually look like even now in the hands of a more innovative entity, what airports could look like, so on and so forth, even the simplest things in transit, private vans would be a drastic improvement over what we have now – and they actually even exist in a few cities, but hardly anybody knows about them. And that is the problem. Frankly, the best thing the government could do is – this is building on Tracy’s observation about what we see with different states and Chris’s point about international comparisons – is experiments. The government should start to be looking for ways to get innovative private sector experiments to try to see how things could be much more innovative and efficient through competition and letting the clamps off to try to innovate. If we don’t do that, we’ll just continue to do what we’re doing, lots of spending, lots of inefficiencies, and it will go on because no one can really envision what the counterfactual is.

Sallie James: Tracy, last word goes to you, what would improve our infrastructure the most?

Tracy Gordon: So, you know, my heart is in state and local finance. That’s what I spend most of my time thinking about. And so, I would love to see more recognition of the role of state and local governments in providing and running infrastructure. I think we all have talked about the importance of looking at the international experience and the importance of experimentation. So, I would like to see funding formulas that are improved to incentivize cost-benefit analysis to be linked to actual measures of performance, and also to try to get at some of the stuff that I found in my work about the high cost of infrastructure here compared to other countries. I think, you know, one explanation that I kind of landed on was fragmentation, that we have so many units of government that have to talk to one another. The Bayonne Bridge project in New York and New Jersey, it wasn’t just New York and New Jersey, there were five overlapping levels of government that had to agree on different kinds of issues and permitting. I think the federal government could do a much better job coordinating those kinds of processes and providing incentives for local governments to get their ducks in order before they say apply for a TIFIA loan or a subsidized loan from the federal government. So, I would like to see more experimentation, especially when it comes to the design of these funding formulas, and not just sticking with the ways that we’ve done things in the past.

Sallie James: That’s an excellent note on which to end. The purpose of Sphere is to debate and consider deeply contentious issues in a respectful forum. I thank you all for doing that here with me today. For more information about Sphere, please go to Projectsphere.org. Thanks so much for watching.